End Of The Furlough Scheme: Review Points for Employers

October 07, 2021

When furlough was introduced in March 2020, no one had predicted that a scheme that was initially set to last for 3 months would continue for a year and more with three extensions. The most recent extension to the Coronavirus Job Retention Scheme (CJRS) is to include the month of September 2021 in the furlough as well. Thus, for payroll providers, keeping up with the HMRC’s changes and updates have been quite difficult since the last year due to the frequent end of minute changes.

Note: Claims for the days under furlough for August 2021 need to be done by the 14th of September 2021. In the case of September 2021 furlough claims, they need to be submitted by the 14th of October 2021. Amendments for the same will be accepted till 28th October 2021.

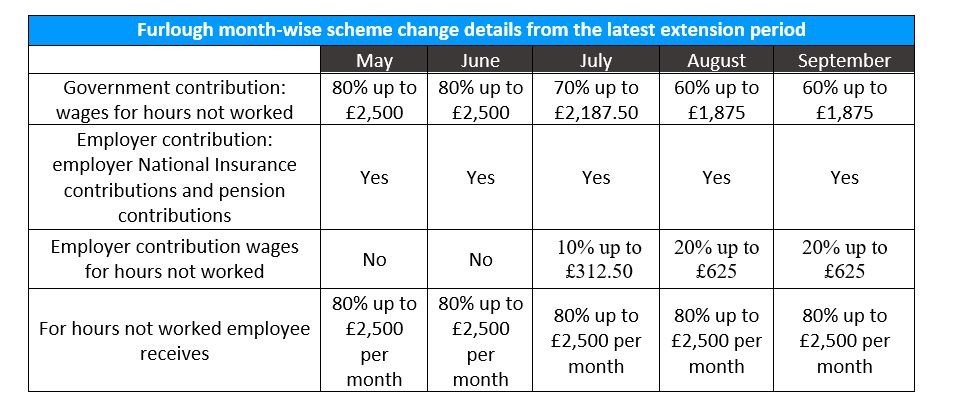

The actual changes to the grant level kick in from July 2021 as the government contribution reduces due to which the employer contribution comes in so that the furlough amount remains at 80%. This is an echo of how the scheme had operated in 2020 when October had been considered the month furlough would end. The cap amount of £2500 however, has undergone no such transformation.

Top-ups are still not mandatory, except for when the employer needs to contribute towards making the employee’s wages reach 80%. However, though holiday pay too can be claimed under furlough by employers, the same would be reclaimed at 80%. That means the remaining 20% (to take it to 100%) would have to be borne by the employer as a mandatory top-up.

The submission window for the claims would begin 14 calendar days post the month of which the claim actually is for. If this date happened to be a bank holiday or if it falls on a weekend then the next working day too would be fine for the claim submission. If you do not have an accounting services provider and are managing the entire claim process yourself, here are a few points to be kept in mind:

- It is possible to make the claim 14 days prior to the actual pay date. Nor do you need to wait for the previous claim period to end to submit the next one

- If you are unable to complete the claim process then it is possible to save a draft of your work so that your progress is not lost

- The claim has to be completed within 7 days otherwise you would have to start over again

- You have a time period of 72 hours within which you can delete a claim if you feel there has been some error made. Also, being an online service, at times things do run slow

If all this seems too difficult you can contact Doshi Outsourcing to make the process simpler for you as you’ll have the experts looking after things.